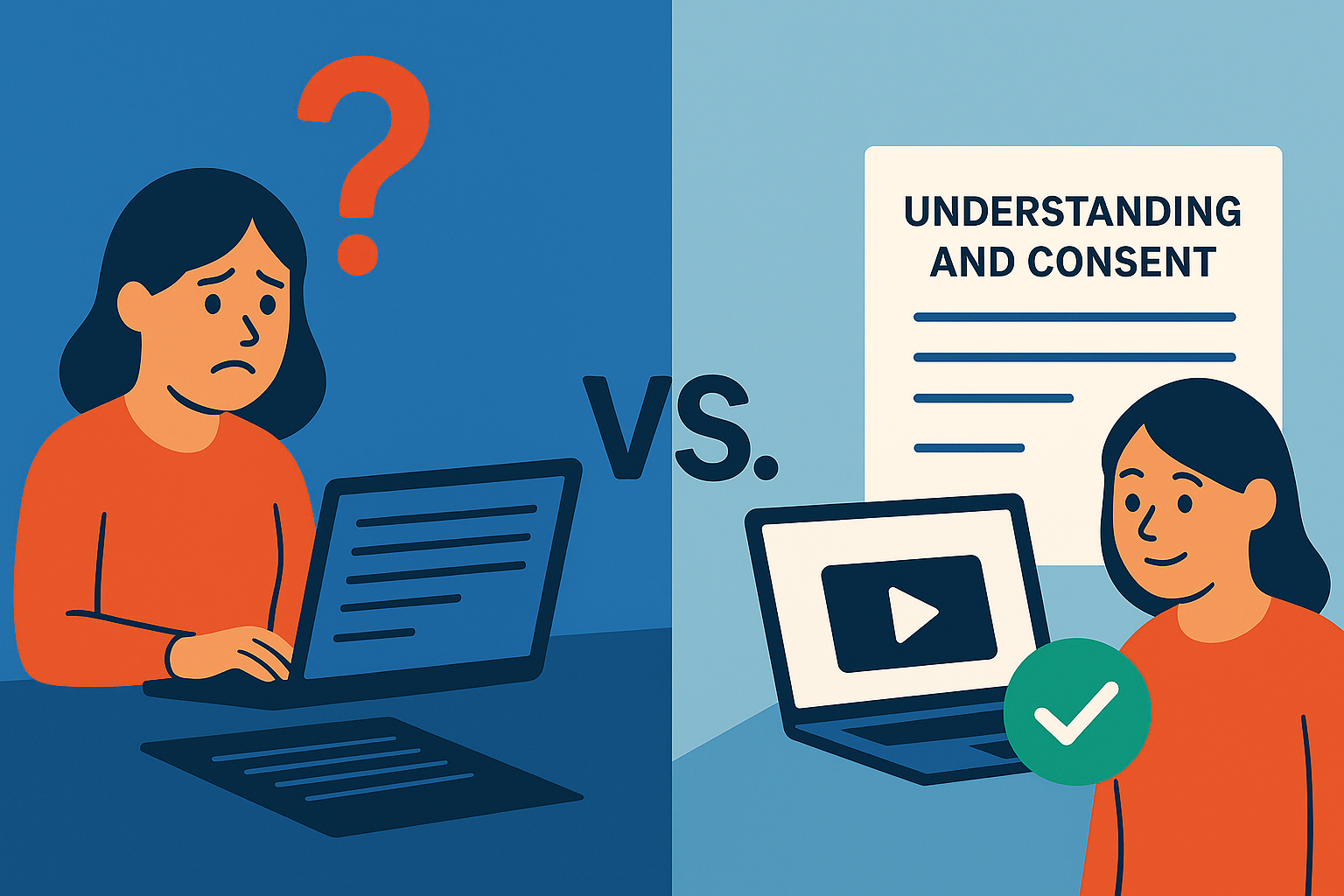

Consumer understanding isn’t just about presenting terms and conditions, it’s about making sure people genuinely grasp what they’re agreeing to.

When customers don’t fully understand, the cost shows up in complaints, disputes, regulatory pressure, and damaged trust. Traditional contracts often fail because they bury key details in dense language, leaving businesses exposed and clients frustrated. Clear, accessible communication, on the other hand, reduces friction, strengthens relationships, and lowers the risk of conflict.

At  i agree, our approach goes beyond capturing agreement to proving real understanding. We help firms demonstrate that customers have engaged with and retained essential information, aligning with regulatory expectations and building stronger client confidence. Consumer understanding matters to every business that wants to reduce risk, protect reputation, and deliver better experiences. Put simply, better understanding isn’t just good compliance, it’s better business.

i agree, our approach goes beyond capturing agreement to proving real understanding. We help firms demonstrate that customers have engaged with and retained essential information, aligning with regulatory expectations and building stronger client confidence. Consumer understanding matters to every business that wants to reduce risk, protect reputation, and deliver better experiences. Put simply, better understanding isn’t just good compliance, it’s better business.

Consumer understanding means that people genuinely grasp what they’re signing up for — not just skimming terms or clicking 'agree' out of habit.

It’s about clarity, not compliance. Understanding, not just acceptance.

In regulated sectors like finance, law, healthcare and insurance, this matters even more. But in truth, every industry suffers when people don't fully understand what they're committing to.

Why? Because misunderstandings lead to complaints, disputes, refunds, and reputational damage.

Consumer understanding is about ensuring your clients:

It’s not enough to just present information. You need to make sure it lands.

Most businesses underestimate how expensive confusion can be.

A poorly understood contract or unclear communication can spiral into:

Refunds and chargebacks

Customer complaints and ombudsman escalations

Increased customer service load

Legal disputes or regulatory interventions

Loss of customer trust and churn

According to research by the UK’s Financial Conduct Authority, poor comprehension of financial products often leads to bad decisions and bad outcomes.

In 2022, the Legal Services Consumer Panel found that nearly 1 in 4 people didn’t fully understand the service they paid for.

Multiply that across your client base, and the cost is enormous.

Worse, misunderstandings often surface after the fact — when emotions are high and trust is gone. Fixing them is far more expensive than preventing them.

Businesses that focus on clarity have an edge. Why? Because when people understand what they’ve agreed to:

They ask fewer questions

They complain less

They’re more loyal

They’re more likely to refer others

Think about the last time you felt unsure about what a company told you — were you happy? Confident?

Clear communication gives people confidence. And confidence leads to trust.

Clarity improves:

Customer retention

NPS scores

Support team efficiency

Legal risk management

In fact, clear language has been shown to reduce call centre traffic by up to 30% in regulated industries, just by lowering confusion.

If your contracts, policies or processes are hard to understand, it’s not just a legal risk — it’s a commercial one.

Most contracts aren’t written for humans. They’re written to tick legal boxes.

The result? People skip them. They scroll past the important stuff. They rely on assumptions.

This creates a gap — between what the business thinks it told the client, and what the client actually took in.

Common issues include:

Excessive legal jargon

Key terms buried in the fine print

Lengthy PDFs sent without explanation

No confirmation of what the client actually saw or understood

In regulated sectors, this is now a red flag. Both the FCA and SRA stress the importance of accessible information.

At  i agree, we help you bridge this gap — making sure your clients genuinely understand the key points before they proceed.

i agree, we help you bridge this gap — making sure your clients genuinely understand the key points before they proceed.

At  i agree, we help businesses turn dry documents into clear, understandable, and trackable experiences.

i agree, we help businesses turn dry documents into clear, understandable, and trackable experiences.

Here’s how we do it:

We take your core content and distil it into key points written in plain English — designed to be read and understood in under a minute.

We generate short explainers in voice or video format, leveraging the production effect (people understand and recall better when information is spoken or visual).

We track what the client saw, when, and for how long — creating an audit trail that proves understanding was encouraged.

For clients who want to dive deeper, the full contract is still there — but the essentials are up front.

This goes beyond e-signatures. This is about informed consent, not checkbox consent.

With  i agree, you’re not just getting a signature. You’re proving the client had every opportunity to understand what they were agreeing to..

i agree, you’re not just getting a signature. You’re proving the client had every opportunity to understand what they were agreeing to..

Any business that asks people to agree to something should care. But the stakes are even higher in sectors where confusion leads to complaints, disputes, or regulation.

If your clients ever say “I didn’t realise that’s what I agreed to”, then this page is for you.

High-risk industries include:

Legal services

Financial products

Insurance

Healthcare

Property and letting agencies

Subscription models and SaaS platforms

Clients who understand are easier to work with. They’re happier, more confident, and more likely to recommend you.

You get fewer complaints. Less friction. Fewer escalations.

It’s good for your team, your bottom line, and your reputation.

If you want to stop problems before they start, start with understanding.

Consumer understanding means making sure clients or customers fully grasp what they’re agreeing to — including the risks, costs, and implications. It goes beyond just showing terms. It’s about ensuring those terms are actually understood.

Clear understanding builds trust, reduces complaints, and protects businesses from disputes or legal issues. It also leads to better customer experiences and lower support costs.

Misunderstandings often lead to complaints, refund requests, legal action, or regulatory scrutiny. In regulated sectors, it can also result in fines or investigations.

i agree help improve consumer understanding?

i agree help improve consumer understanding?

We summarise contracts in plain language, use video or audio to explain key points, and provide tracking so you can prove what the client saw and understood. It’s designed to reduce confusion and increase confidence.

Yes. Regulators like the FCA and SRA now expect businesses to ensure clients understand key information. Our platform helps you stay ahead of those expectations.

Yes. When clients know what to expect, they’re far less likely to raise complaints or disputes. It’s a proven way to lower risk and improve satisfaction.

If you have more questions, take a look at our full FAQs page where we cover a wider range of topics in more detail. It’s a quick way to find answers and explore other subjects that might be useful to you.